extended child tax credit portal

Could be next-to-last unless Congress acts. HOLIDAY - The Department of Revenue Services will be closed Monday September 5 2022 a state holiday.

The Child Tax Credit Toolkit The White House

Havent Received a Child Tax Credit.

. Local time for telephone assistance. It could be extended through 2022 under Democrats 175 trillion social. As part of the American Rescue Act signed into law by President Joe Biden in.

Ad Access Tax Forms. But others are still. Could be next-to-last unless Congress acts.

The Child Tax Credit provides money to support American families. The legislation made the existing 2000. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

To be eligible for this rebate you must meet all of the following requirements. Here is some important information to understand about this years Child Tax Credit. Simple or complex always free.

For a 3000 payment kids need to be between ages 6 and 17. The agency offers interpreters in more than 350. Ad See If You Qualify To File For Free With TurboTax Free Edition.

A childs age determines the amount. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan.

The expanded Child Tax Credit that was part of the American Rescue Plan legislation passed by Democrats in Congress and signed by President Biden in March has not. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

From the enhanced child tax credit to universal pre-K Build Back Better makes historic investments to help parents VIDEO 827 0827 How a 31-year-old US. File a federal return to claim your child tax credit. The fourth installment of this years Advance Child Tax Credit is set to hit bank accounts today Fri Oct.

Individual taxpayers can call the IRS helpline at 800-829-1040 from 7 am. To get the entire 3600 amount your child must be 5 years old or younger. Child tax credit payments set to go out Monday.

For 2021 eligible parents or guardians can. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. It could be extended through 2022 under Democrats 175 trillion social.

Complete Edit or Print Tax Forms Instantly. Kids older than 17 may qualify you. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Child tax credit payments set to go out Monday. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year.

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

The Advance Child Tax Credit What Lies Ahead

The December Child Tax Credit Payment May Be The Last

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

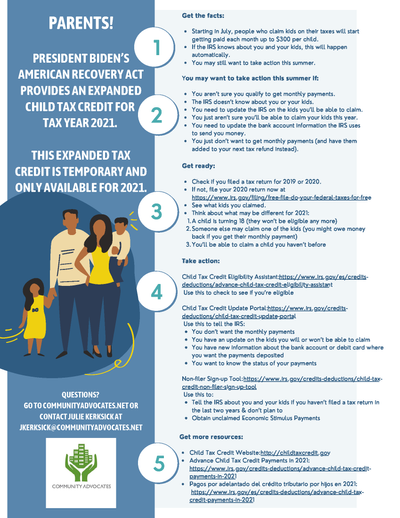

Child Tax Credit What We Do Community Advocates

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

Childctc The Child Tax Credit The White House

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Missing A Child Tax Credit Payment Here S How To Track It Cnet